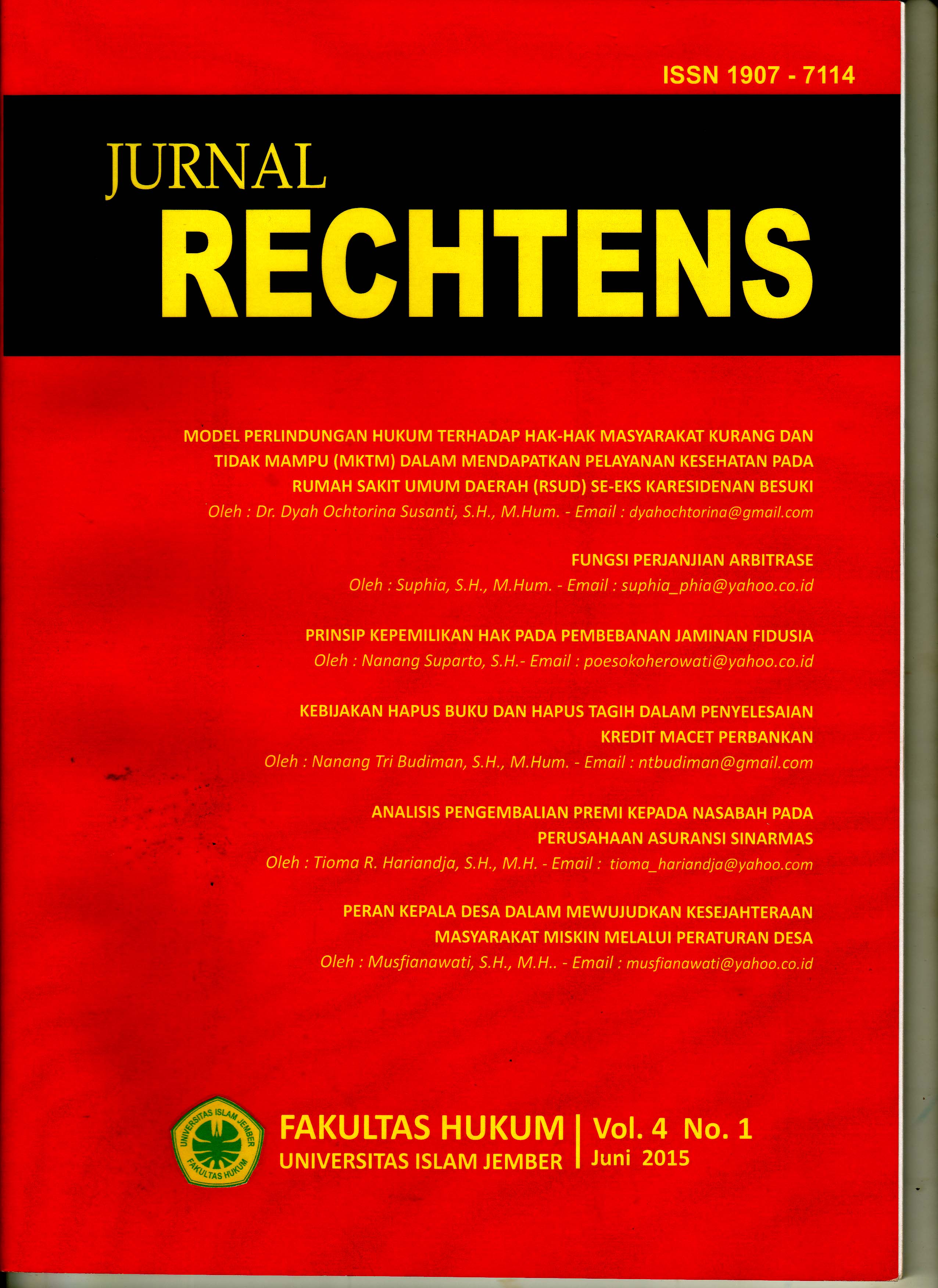

Analisis Pengembalian Premi kepada Nasabah pada Perusahaan Asuransi Sinarmas

DOI:

https://doi.org/10.36835/rechtens.v4i1.112Abstract

Lack of interest of the community will follow the insurance, make a dilemma for the insurance business so that the insurance premium refund innovation into new tricks to provoke interest of the community and businesses to stand up to insurance customers. Basically the insurance is a financial settlement method, where by following one of the insurance products that are consistently the existing funds have been programmed. That is insurance indirectly managing the financial administration of income and expenditure for sure. Insurance agreement is consensual, the agreement formed since the existence of an agreement between the insured and the insurer (Article 257 paragraph 1 of the Code of Commercial Law (Commercial code)). In the insurance agreement, a system of accountability in the form of Torts. The compensation paid in the event of uncertain events that have been agreed in the insurance agreement. Nominal amount of liability provision in the insurance agreement known by the nominal amount of the premium paid customers as an insurance fund. The premium can be paid in installments (monthly, quarterly or yearly) or at a time up to the deadline that has been agreed.