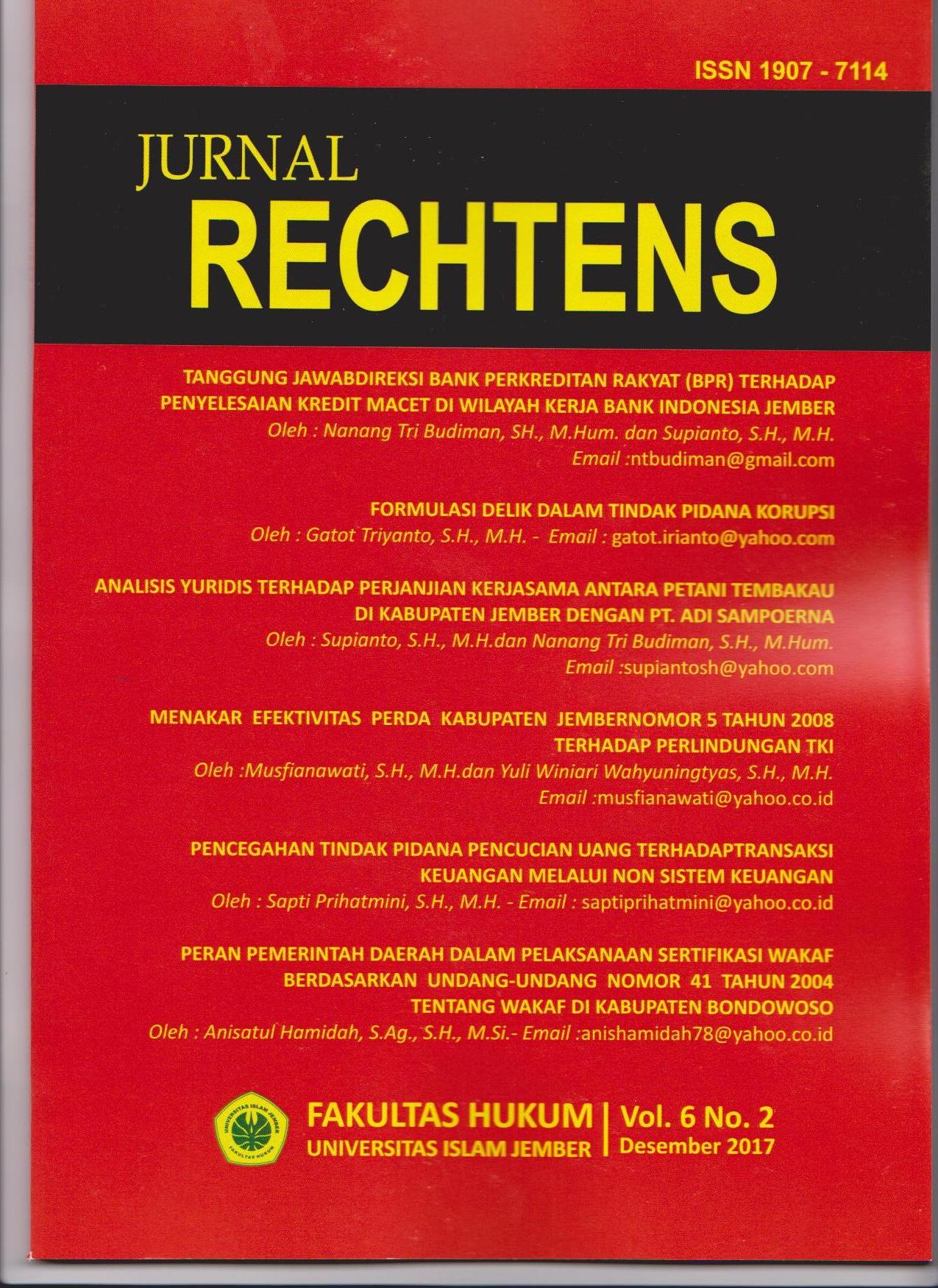

Tanggung Jawab Direksi Bank Perkreditan Rakyat (BPR) terhadap Penyelesaian Kredit Macet di Wilayah Kerja Bank Indonesia Jember

DOI:

https://doi.org/10.36835/rechtens.v6i2.201Abstract

The problem of bad debts in the practice of banking credit channeling often occurs. This can be caused by many things, both internal and external factors. The Board of Directors of the Company, in this case Rural Bank, as the Company's authorized organ and fully responsible for the management of the Company for the interest of the Company, in accordance with the purposes and objectives of the Company, has responsibility for the incurrence of bad debts and settlement. This study formulates the problems that arise in the practice of banking credit distribution, especially in the BPR in relation to the responsibilities of the Directors of Rural Banks against the settlement of bad debts: what factors cause the bad credit in the BPR in the working area of Bank Indonesia Jember and how the form of responsibility Board of Directors of BPR in case of bad credit. The method in this research is empirical juridical approach with this method is intended to know and understand the factors that cause bad credit and how the form of responsibility of directors to bad credit. Based on the result of the research, it can be concluded that the bad debts occurring in the working area of Bank Indonesia Jember are caused by several factors, such as customers experiencing crop failure or due to unfavorable natural condition, The market economic fluctuation caused the economy to become unstable; Inadequate analysis; There is a divorce between husband and wife of the customer; and the debtor is entangled in legal matters so that it is unable to settle its obligations to the creditor. Board of Directors BPR The Board of Directors is responsible for the management of the RB and shall be carried out in good faith and with full responsibility. In the event of bad credit, the responsibility of RB directors is in the form of striving for the settlement of non-performing loans in order to be repaid by the customer.